All responses should recognize that there is no room in the car for the seventh girl and her luggage, although the condominium will accommodate the extra person. This means they will have to either find a larger vehicle and incur higher gas expenses or take a second car, which will at least double the fixed gas cost. Danielle Smyth is a writer and content marketer from upstate New York.

Costs of Production

All these costs will change because the estimates are accurate only in the short term. Variable costs will change depending on how many products you buy or manufacture. For a cost to be considered variable, it needs to vary based on some activity base.

Committed vs Discretionary Fixed Cost FAQs

Their wages generally support the production process but cannot be traced back to a single unit. For this reason, the production supervisors’ salary would be classified as indirect labor. However, if you are considering the supervisor’s salary cost on a per unit of production basis, then it could be considered a variable cost. The third major classification of product costs for a manufacturing business is overhead. These overhead costs are not directly attributable to a specific unit of production, but they are incurred to support the production of goods. Some of the items included in manufacturing overhead include supervisor salaries, depreciation on the factory, maintenance, insurance, and utilities.

Product versus Period Costs

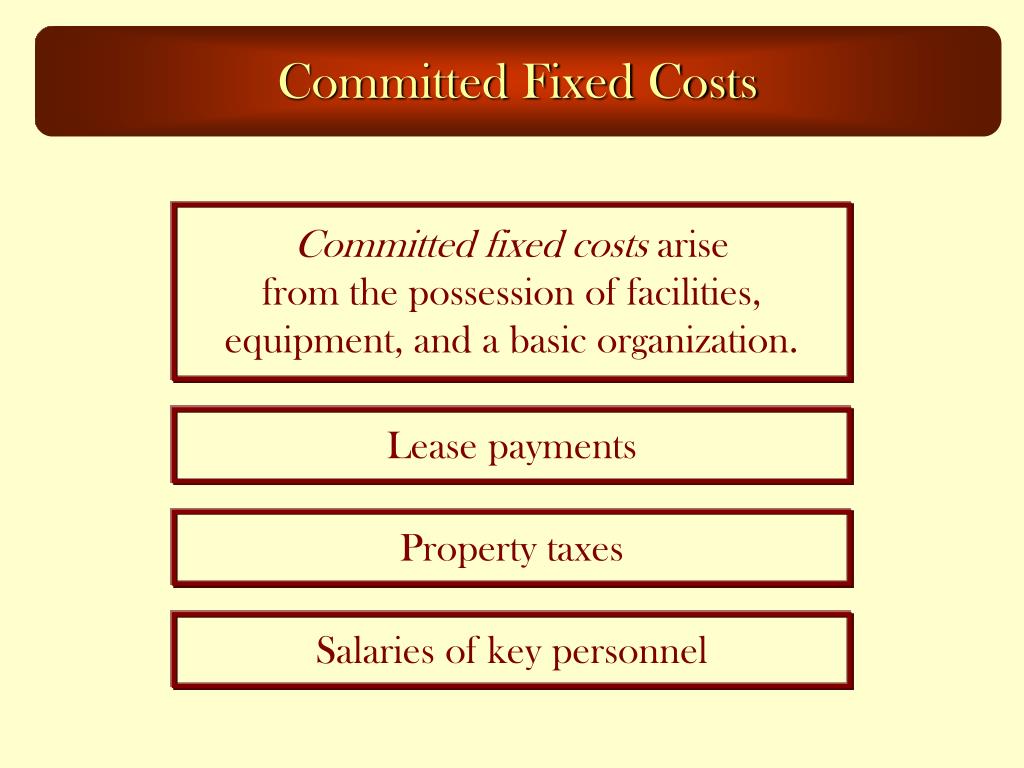

It is important to know how total costs are divided between the two types of costs. The division of the costs is critical, and forecasting the earnings generated by various changes in unit sales affects future planned marketing campaigns. These costs are often contractual or legally binding, making it challenging for businesses to reduce or eliminate them without incurring penalties or legal consequences.

2: Identify and Apply Basic Cost Behavior Patterns

The costs that do change as the number of participants change are the variable costs. The food and lift ticket expenses are examples of variable costs, since they fluctuate based upon the number of participants and the number of days of activities. Committed fixed costs are fixed costs that typically cannot be eliminated if the company is going to continue to function. An example would be the lease of factory equipment for a production company. Committed Costs are an essential aspect of a company’s financial management, representing long-term financial obligations that cannot be easily altered.

Business in Action 2.2

Where Y is the total mixed cost, a is the fixed cost, b is the variable cost per unit, and x is the level of activity. The only way to accurately predict costs is to understand how costs behave given changes in activity. To make good decisions, managers must know how costs are structured (fixed, variable, or mixed). The next section explains how to estimate fixed and variable costs, and how to identify the fixed and variable components of mixed costs.

Fixed costs are clearly a large component of total operating expenses, which makes it difficult for airline companies like United Airlines to make short-term cuts in expenses when revenue declines. Opportunity cost is the benefits of an alternative given up when one decision is made over another. This cost is, therefore, most relevant for two mutually exclusive events. In investing, it’s the difference in return between a chosen investment and one that is passed up.

They provide stability and represent investments in the infrastructure and resources necessary for the business to operate efficiently. On the other hand, discretionary costs are more flexible and can be adjusted based on the business’s needs and financial situation. They allow businesses to allocate resources strategically and adapt to changing circumstances. Both types of costs play a crucial role in the financial management of a business, and understanding their attributes is essential for effective decision-making and planning.

These changes in variable costs per unit could be caused by circumstances beyond their control, such as a shortage of raw materials or an increase in shipping costs due to high gas prices. In any case, average variable cost can be useful for managers to get a big picture look at their variable costs per unit. Most of how to do your company’s payroll yourself the costs were committed fixed costs (e.g., teachers’ salaries and benefits) and could not be eliminated in the short term. In fact, teachers and students at the school being considered for closure were to be moved to other schools in the district, and so no savings on teachers’ salaries and benefits would result.

- The third major classification of product costs for a manufacturing business is overhead.

- While these costs may not directly contribute to revenue generation, they are crucial for maintaining the overall operations and reputation of the business.

- Further, when additional machinery or equipment is placed into service, businesses will see their fixed costs stepped up.

Both of these costs could potentially be postponed temporarily, but the company would probably incur negative effects if the costs were permanently eliminated. These classifications are generally used for long-range planning purposes. Sierra Company is trying to identify the behavior of the three costs shown in the following table. Calculate the cost per unit, and then identify how each cost behaves (fixed, variable, or mixed). In contrast, a committed fixed cost would be if you had proposed the same new service and many clients were interested; the sales team was able to arrange numerous signed contracts based upon the new service.

They are often time-related, such as interest or rents paid per month, and are often referred to as overhead costs. They are important to attaining more profit per unit as a business produces more units. Costs such as rent, property taxes, utilities and administrative wages will need to be paid whether you manufacture one item or thousands of items. For example, if your sales get to a point where you need to add an additional manufacturing facility your rent, property taxes and other fixed costs may rise. During planning and budgeting, it is important to know what your fixed costs are and how they affect the profitability of the company.